De-risking Commodities

Portfolio Changes to Reduce Metals Exposure

This letter reads WAY better in your browser than in your email - so do yourself a favor and click on the title above to read it that way.

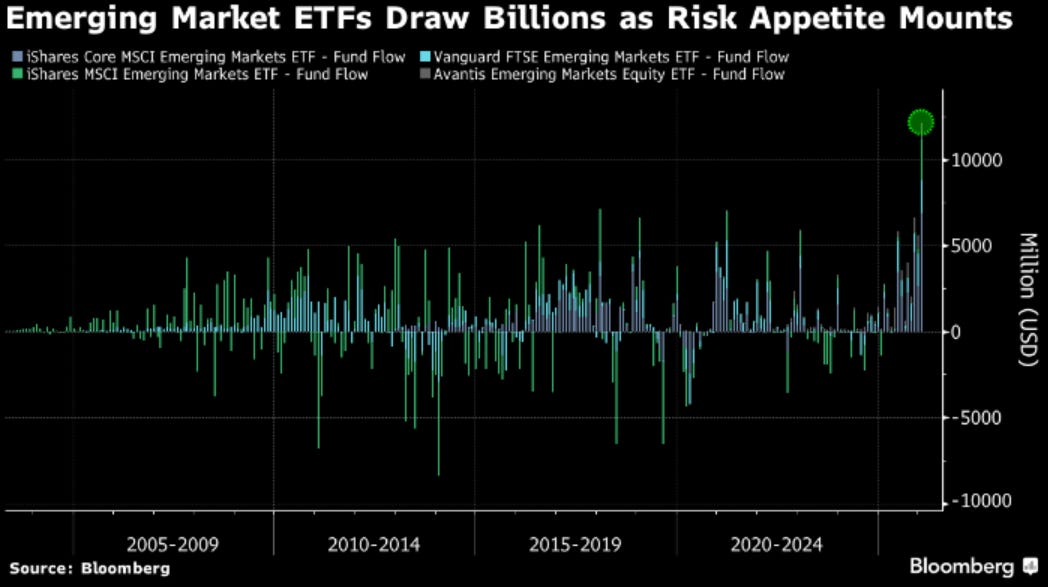

We enter a pullback…but we also just got started. Timeframes matter.

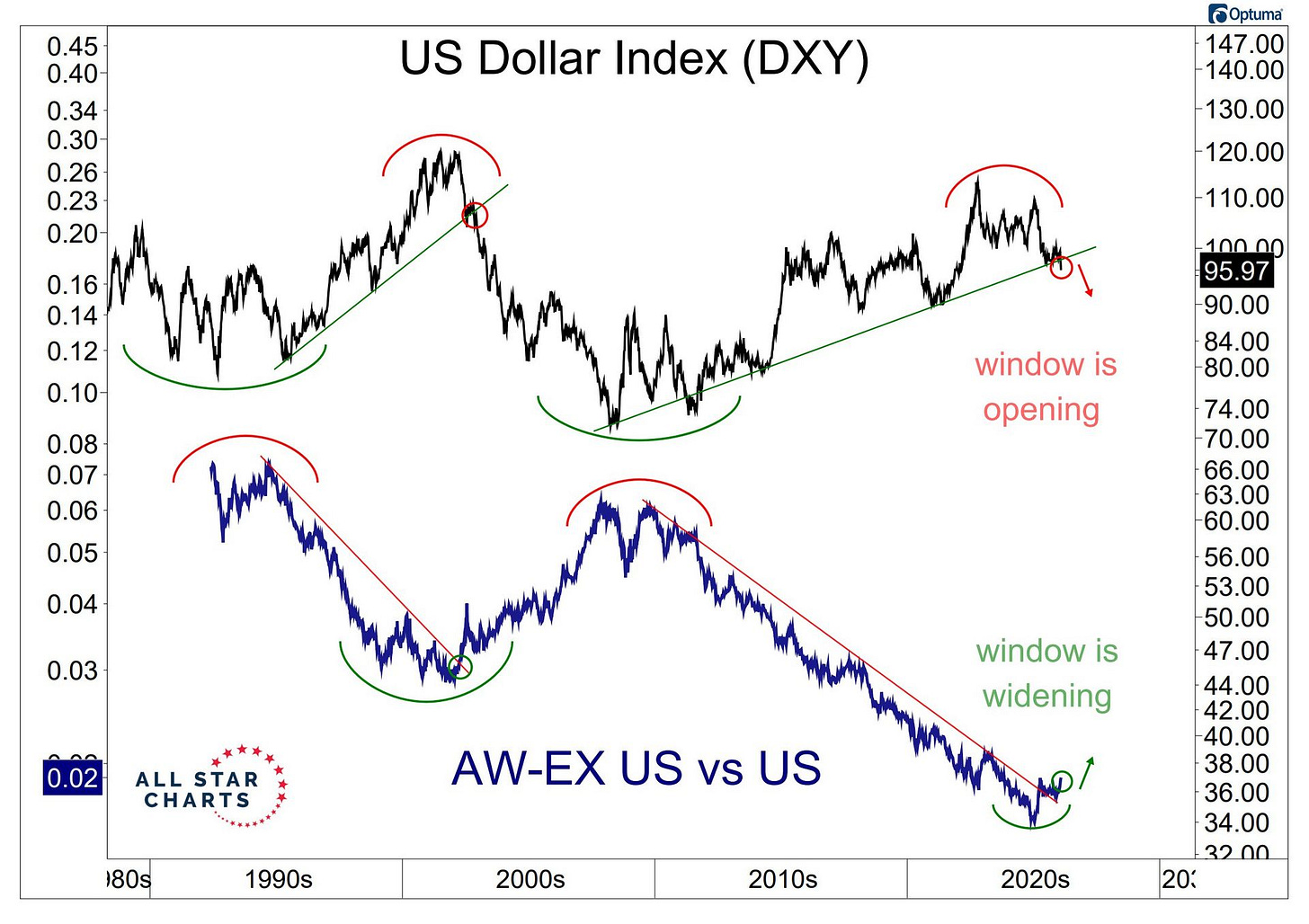

The Dollar

The 15 year uptrend in the trade-weighted Dollar is hanging by a thread but we did save the breakdown horizontally which matters for now.

That bounce was a big deal to close the month. It makes FEB very important for the DXY and of course Passport stocks.

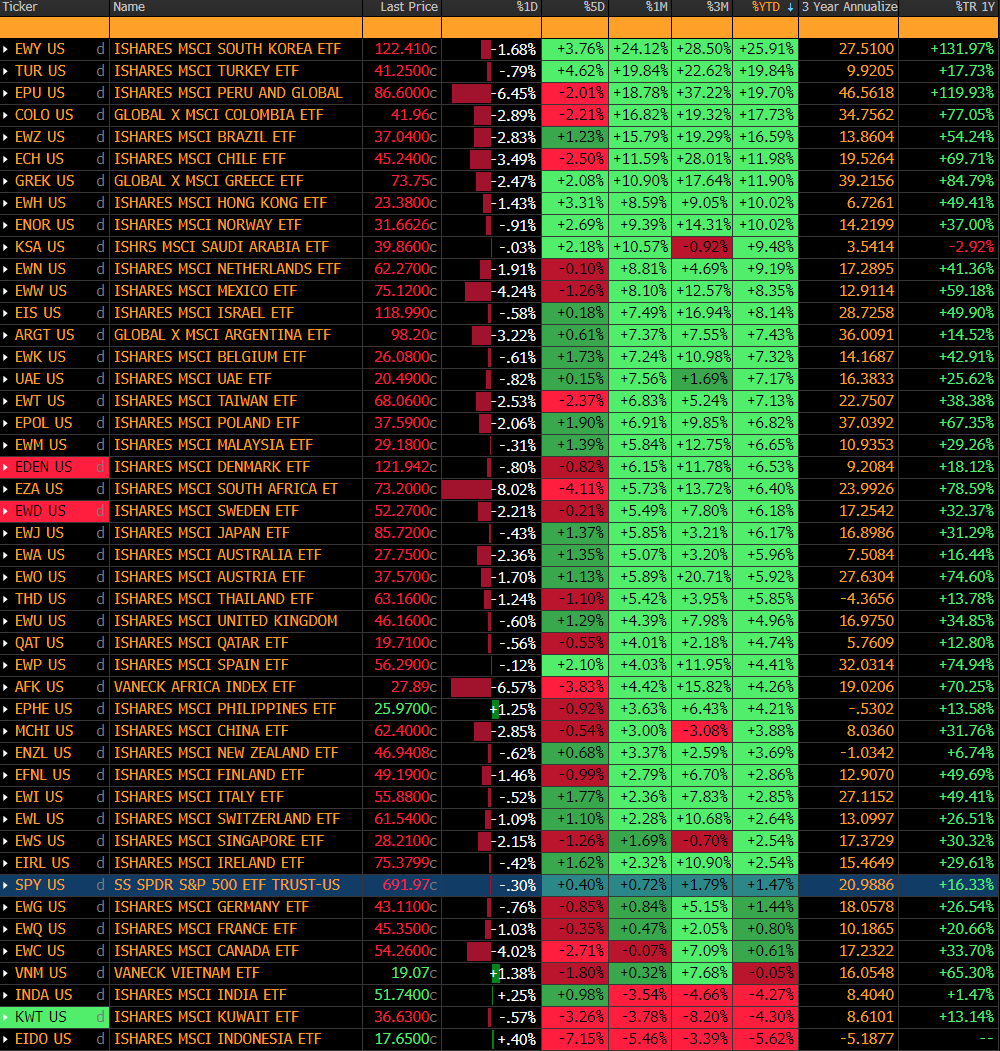

The Scoreboard

The US is now beating 7 countries but badly underperforming a couple dozen others. Indonesia is now the worst on the year but we think they likely fix their issues MSCI raised.

Interesting Data

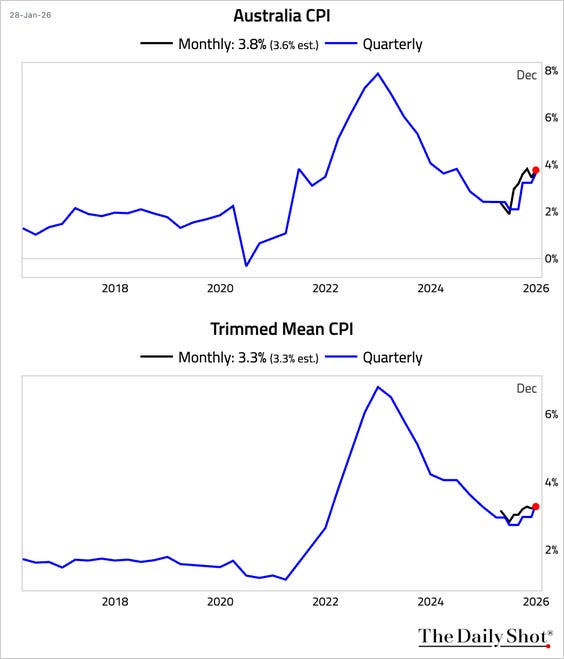

Australia - EWA 0.00%↑

Getting warm in here…

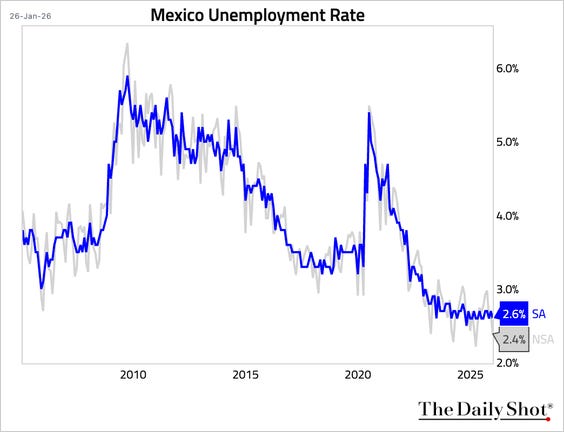

Mexico - EWW 0.00%↑

Impressive.

Australia - EWA 0.00%↑

Trimmed mean inflation in Australia bouncing well north of the old range. Folks not only do not see hikes but more cutting yet so the next print sure matters.

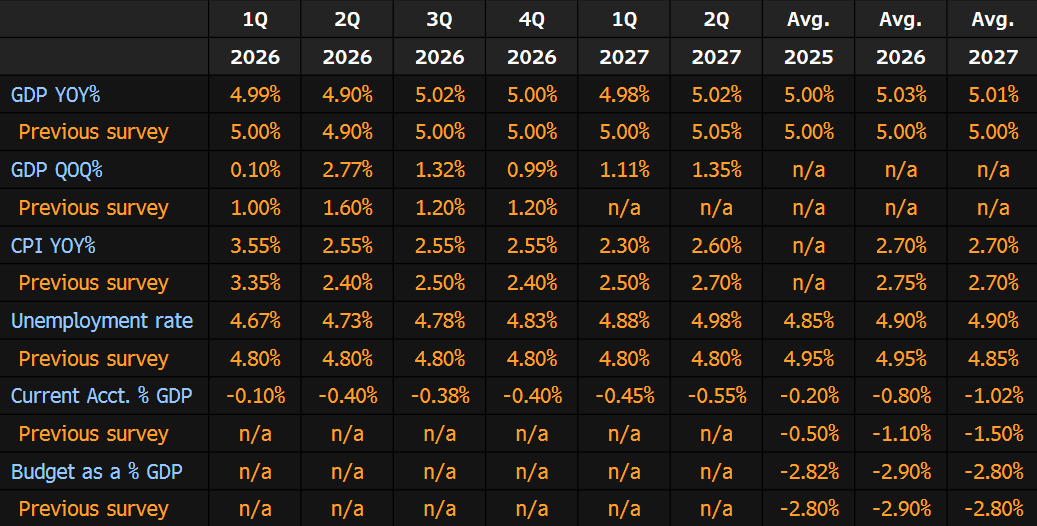

Indonesia - EIDO 0.00%↑

Indonesia has political issues galore and now some MSCI issues but they look to keep growing at 5% with sub 3% inflation and sub 5% unemployment.

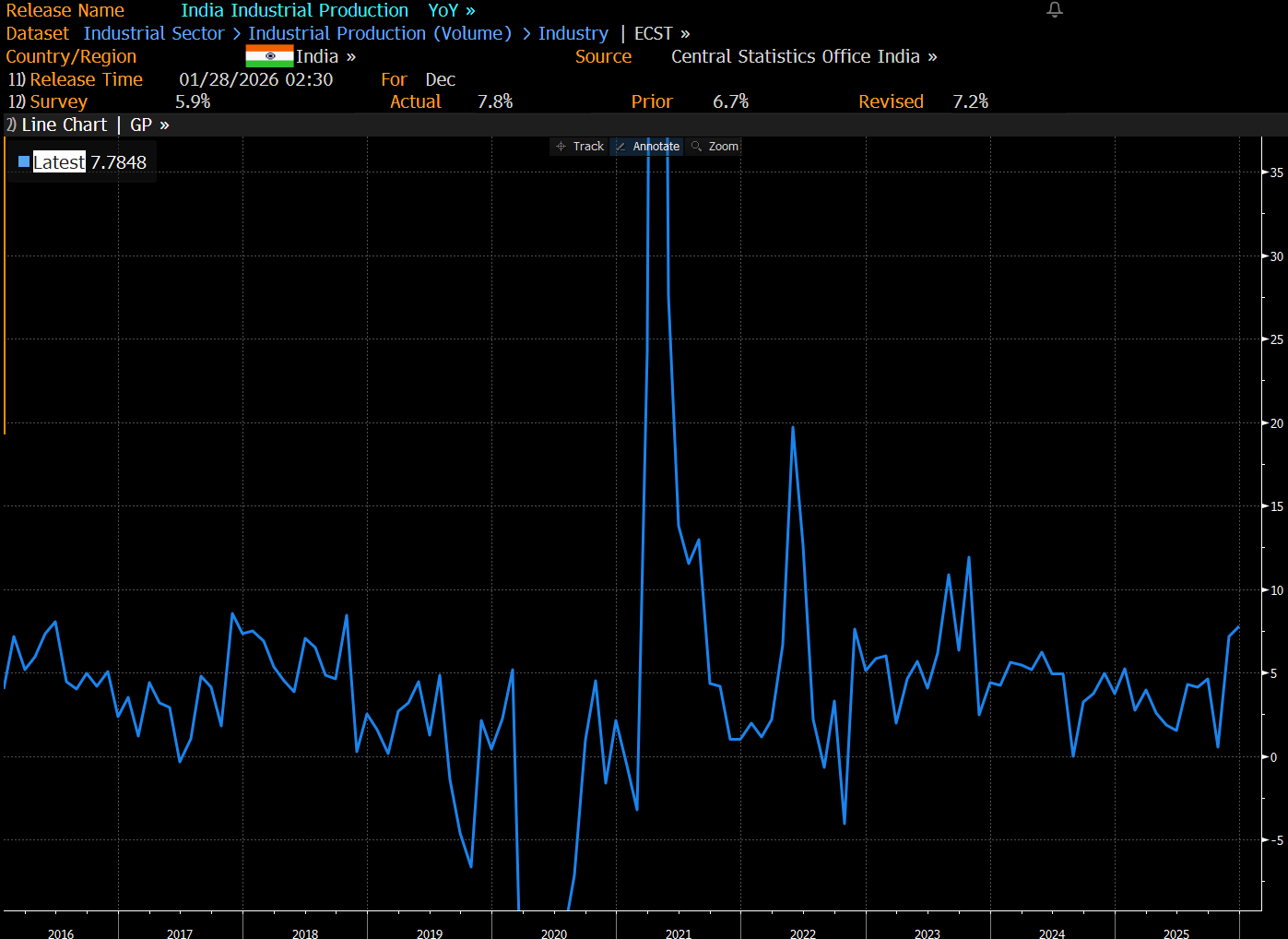

India - INDA 0.00%↑

Industrial production best growth since 2023 in India.

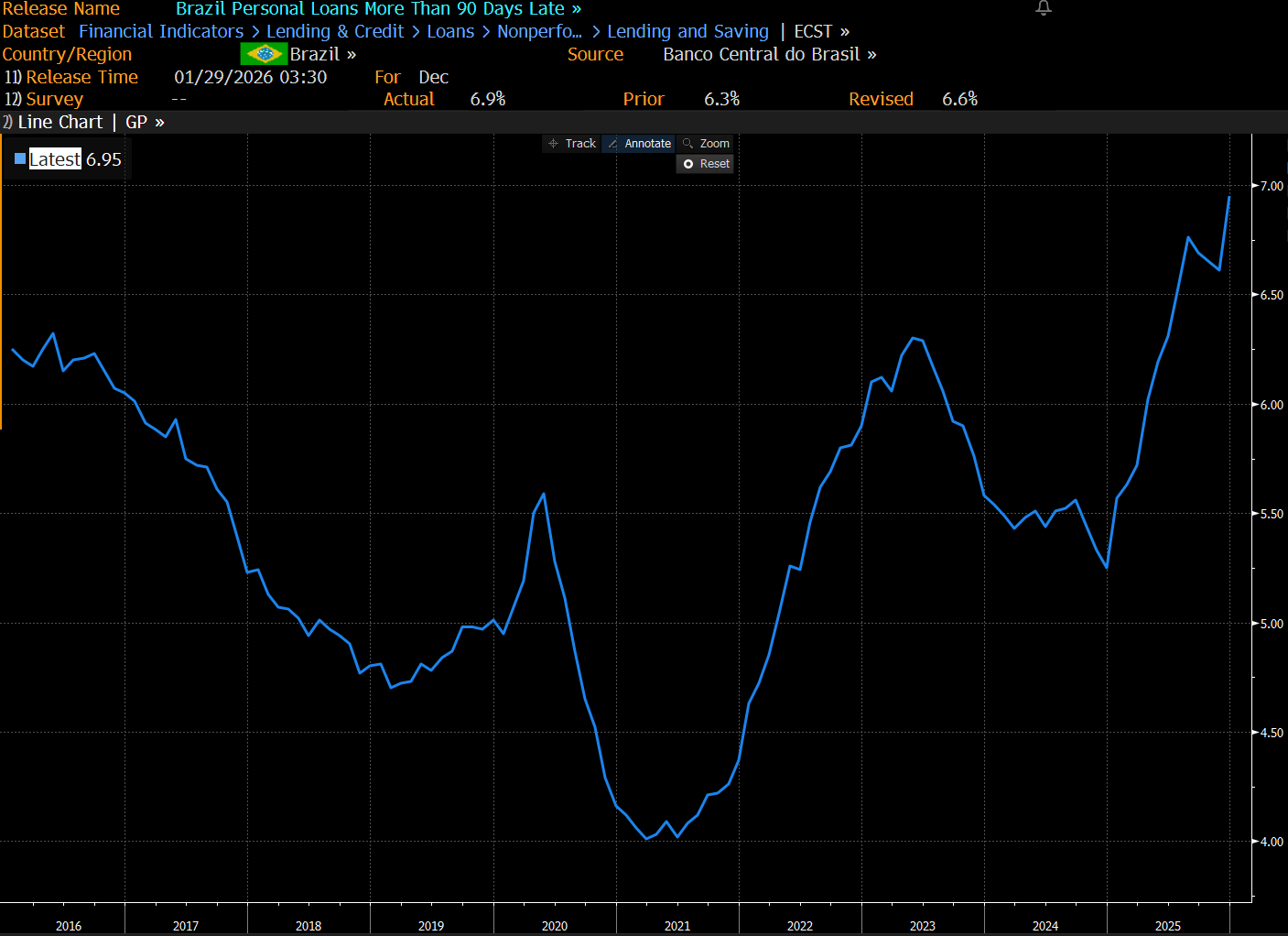

Brazil - EWZ 0.00%↑

Not ideal…

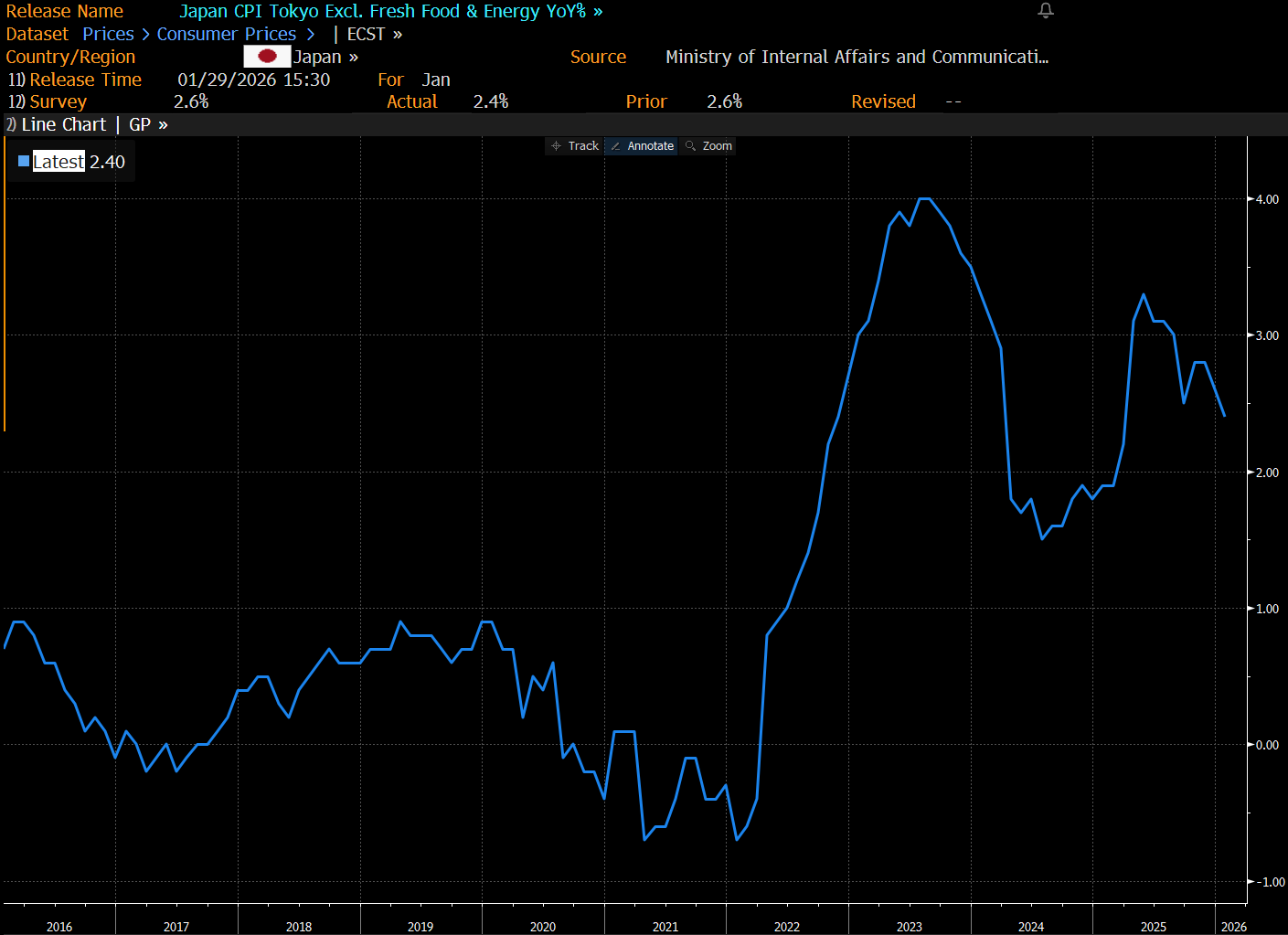

Japan - EWJ 0.00%↑

Tokyo inflation was cool (ex food/energy pictured).

Interesting News

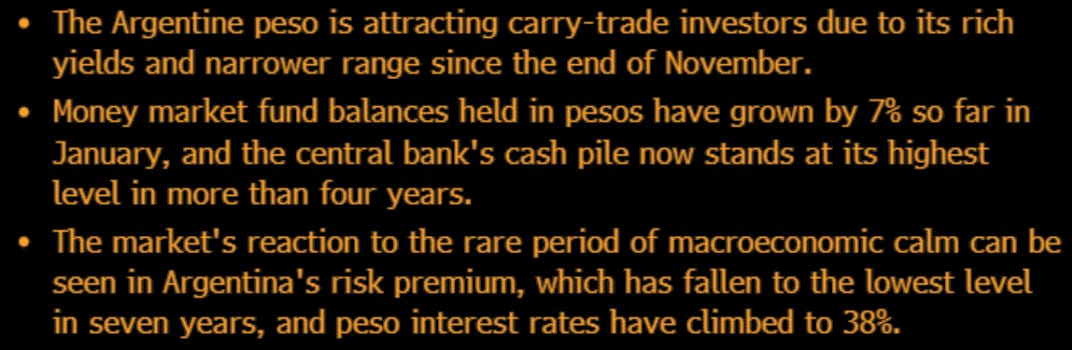

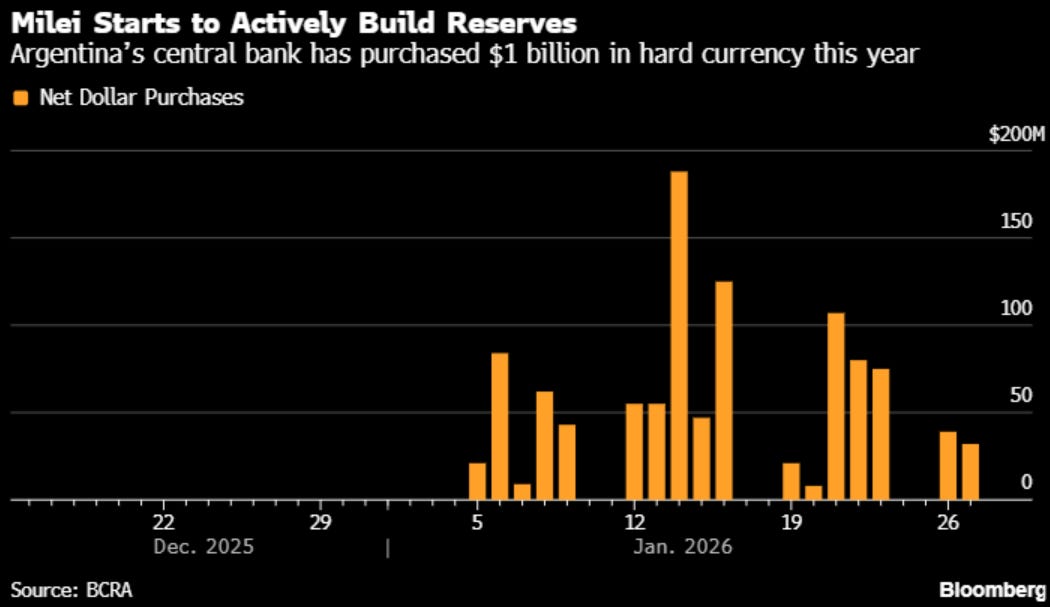

Argentina - ARGT 0.00%↑

Bold strategy Cotton…

India - INDA 0.00%↑

Keep reading with a 7-day free trial

Subscribe to Pinecone Passport to keep reading this post and get 7 days of free access to the full post archives.