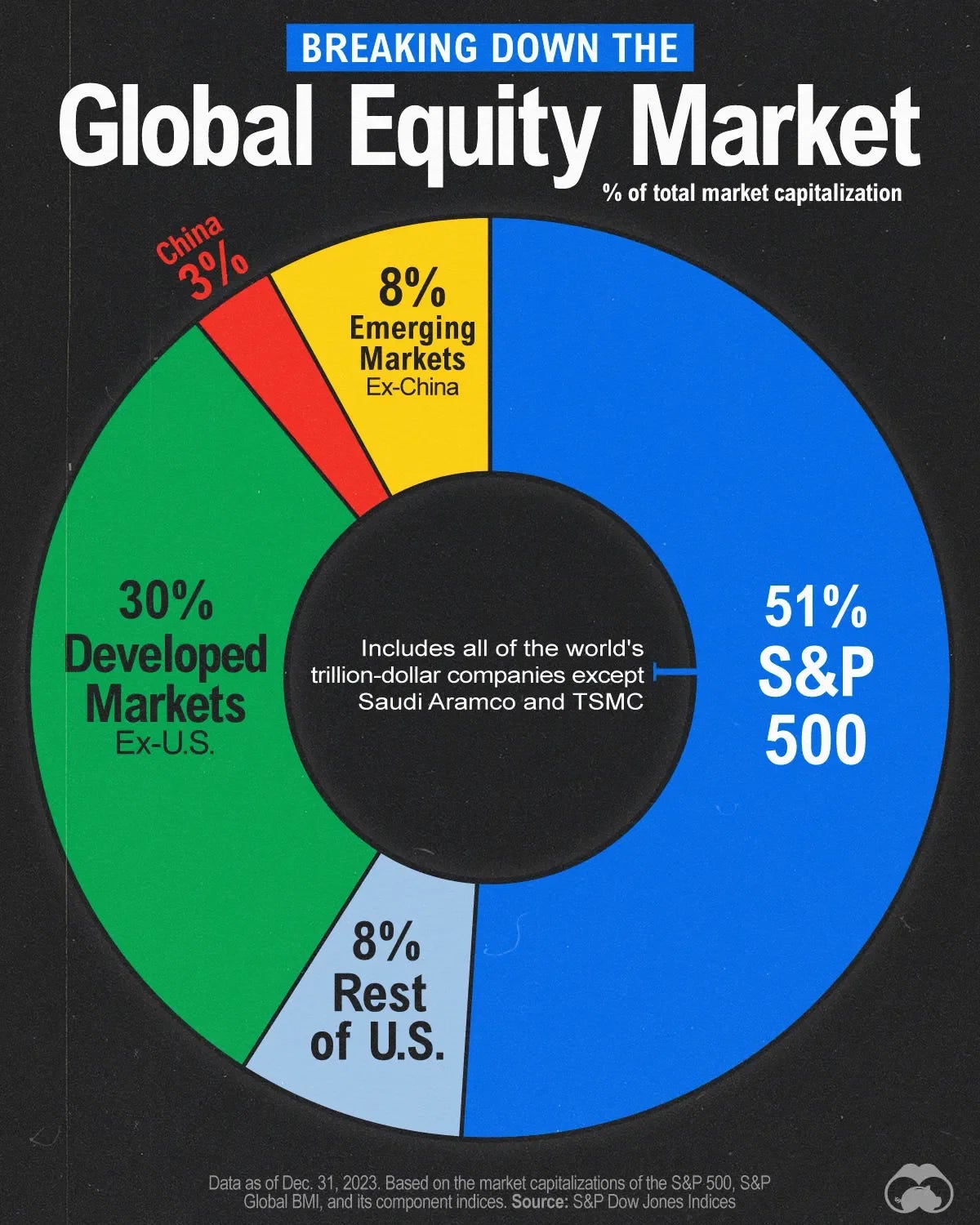

As you may know, the MSCI World Index is 72% US stocks and the MSCI All Country World Index is 65%. As for % of global market cap - the US is a bit above 60% these days (the graphic below is a year old). The US is about 12% of global GDP and 4% of global population. The US clearly deserves a premium with the great earnings growth, the great profit margins, and the dynamic system. But the above numbers may have more to say about the giant budget deficit, trade deficit, buybacks, and passive inflows than they do about the real underlying strength. None of us knows when the winds change or the tide goes back out so this letter may end up as an exercise in futility for a few years - but at some point - international exposure will matter greatly to portfolios (especially us home country biased Americans).

This letter is for folks that think US market dominance may not last forever and prefer to explore other countries on a journey of learning more about them and investing in them instead of just buying some International ETF or mutual fund from Blackrock or Vanguard. If you (like me) think investing in Southeast Asia is a good idea - Vanguard ($VXUS) will give you less than 3% exposure to SE Asia and over 25% to Japan and the UK.

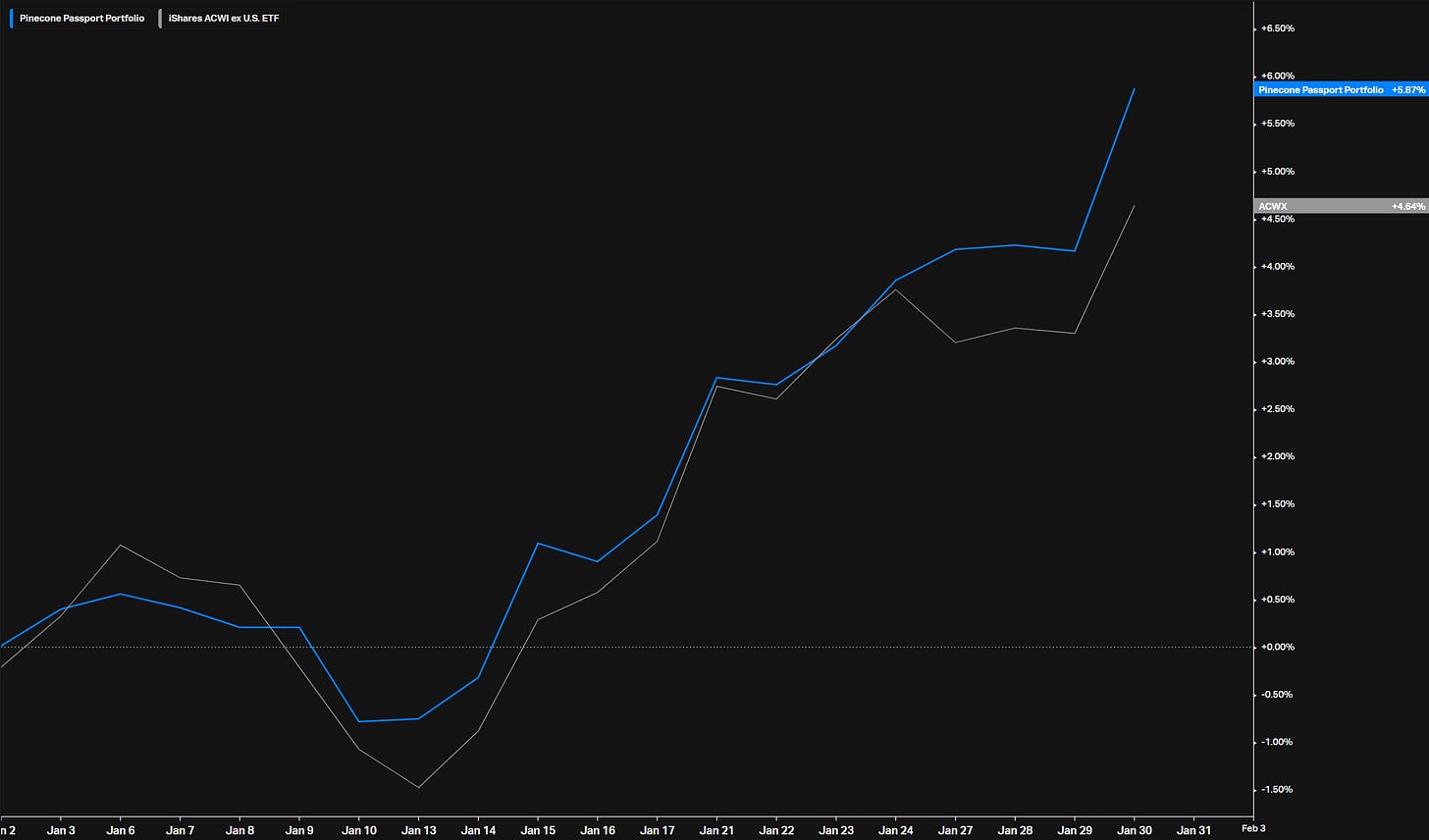

The letter will feature news, data, and analysis of the countries that offer ETFs and we will attempt to assemble a portfolio of country ETFs that outperform the ACWI Ex US ETF. The thought is, at some point this can even outperform *gasp* the SPX at times. It will be a journey of learning and investing outside of the US and a resource to keep up with how the other 94% of Earth’s land mass are doing economically, financially, politically, and socially/culturally. Now to be super clear this is currently 43 countries on my list (okay one is all of Africa) which means I will miss a ton of stuff from each all the time - if it was all of the news and data from each it would be unreadable of course. So understand that it will be highlights we found interesting and we will miss stuff. So if you are a Peru export and we miss last month’s consumer confidence number or that protest or central bank move - yep - gonna happen. The point is to keep up at a high level with 43 countries for the purposes of putting money to work in the ones with the most potential in our view - not to bore you with the noise. With that - let’s grab our passport and begin our journey. If you like the letter, please let folks know because we have about zero subscribers right now and our first goal is to make beer money for all the time spent.

The Scoreboard

That is 28 countries beating the S&P 500 a month into the year. Also, interesting to see India in the bottom 3 eh!

Interesting Data

Brazil’s budget deficit surprised bigger than expected and as you can see - is running very big compared to the last decade.

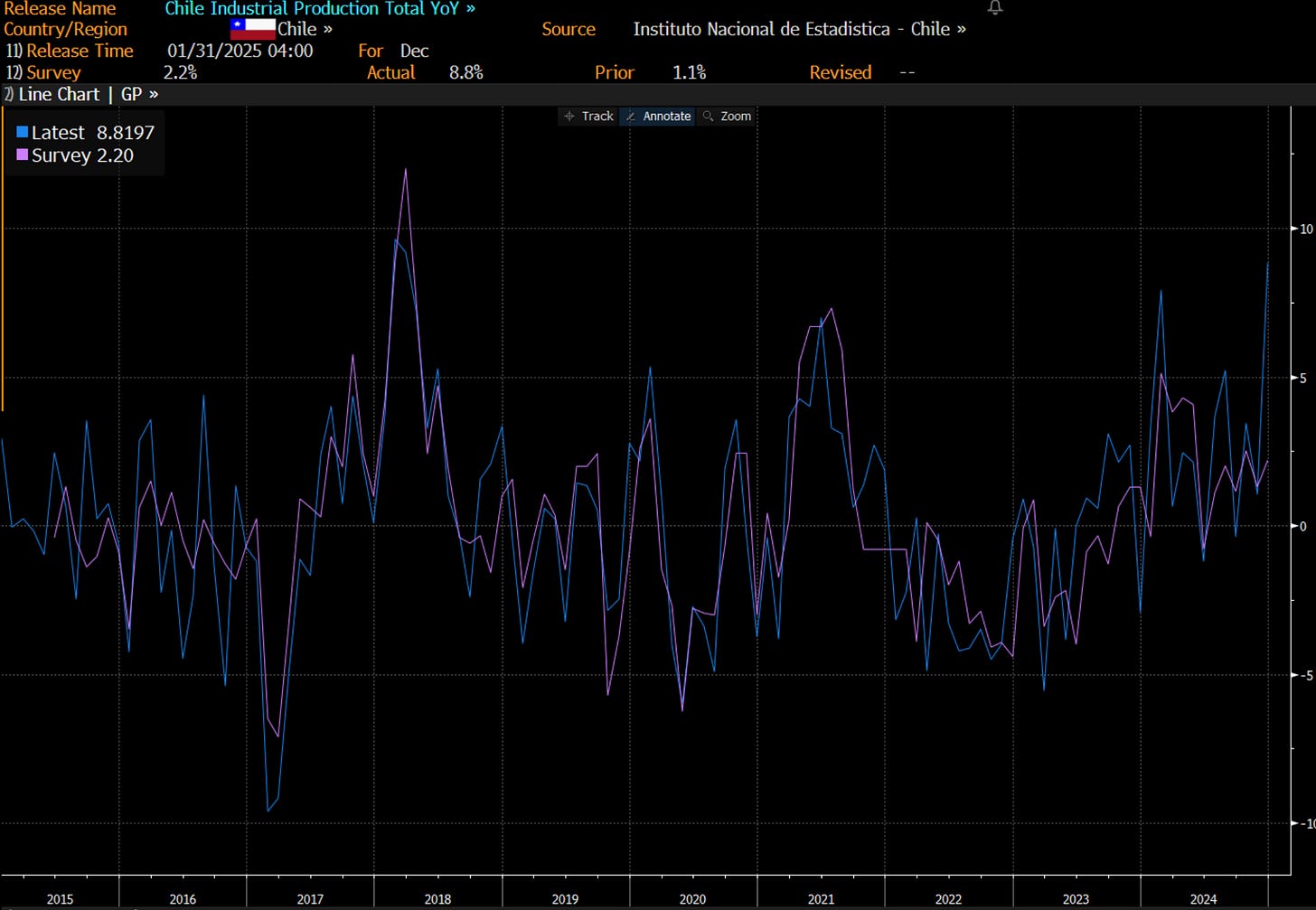

Industrial production is on fire in Chile.

Spain’s unemployment rate keeps making new lows.

Interesting News

That one is important because Qatar may be able to build a pipeline through Syria one day to ship gas to Europe. Never sleep on pipeline politics.

Interesting Charts

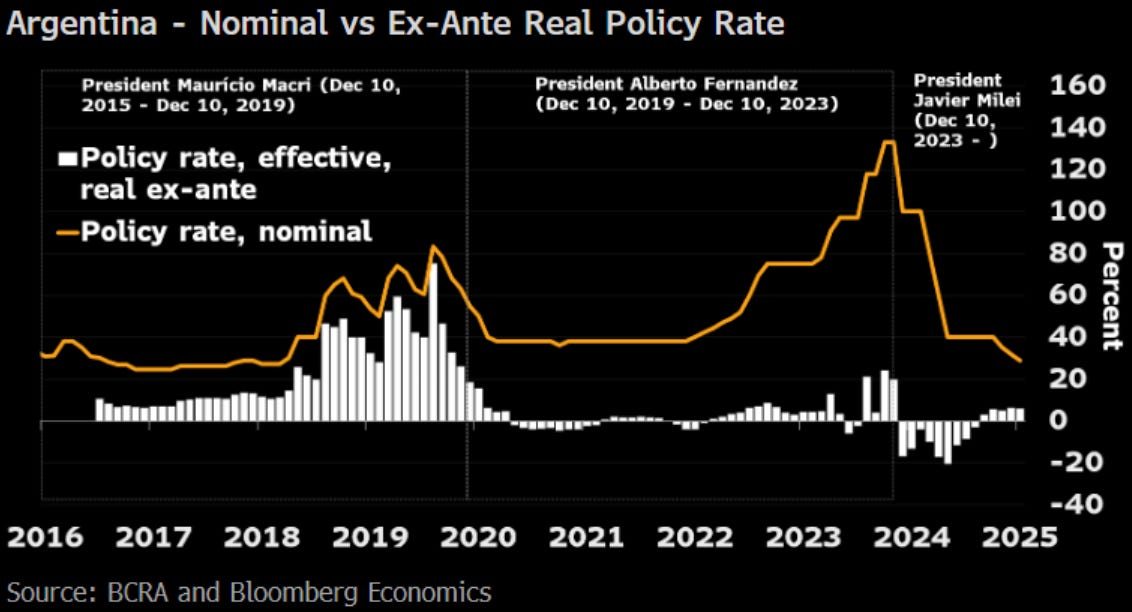

Argentina is cutting rates as the fiscal side does the tightening along with the controls still in place around FX. They are set to slow down Peso depreciation. This is interesting as Milei the Austrian has a bit of an MMT view here that high rates paid to depositors and bond holders are adding liquidity which is inflationary.

The Brazilian labor market is TIGHT and real wages are solid. Problem of course is that rates are jumping and it will be an issue at some point. For now, Lula continues to run it hot and put the pressure on the BCB to push against it. This pushed everyone out of stocks and into bonds but the earnings for now are of course solid and it has helped push the PE to VERY low levels.

The Dollar has made a fool of every way of trying to predict FX strength abroad.

I would not have guessed this.

I would have guessed this.

Price Charts

Africa looks interesting here and super bullish if we can break about $17.25. Cheating here as this is a giant continent and not a country but it is not my fault nobody makes African ETFs!

Country of the Week - Chile

Trying to break out here with some nicely curling up moving averages after 15 years of pain.

Chile passed major pension reform this week - but who cares with tariff headlines! Copper production being up 14% YoY in Chile does not hurt either. But speaking of tariffs - this reform may put into question America’s position as the fund manager for most of these pension funds. The Donald may not like that - so be careful here.

Chile has also been helping the US with this - which may help keep DC onside. Chile has even reduced diplomatic relations with Venezuela in the last couple of weeks.

Chile has rates at 5% (only Peru lower in the region) and inflation fell MoM and is running at 4.5%. Activity beat expectations this past month and industrial production was very strong.

The Passport Portfolio

Here is the portfolio - it goes back to 1JAN and gets rebalanced monthly. Check out the dividend yields!

For now - we are very Middle East and LatAm heavy.

Good start to the year but it is only one month in.

That is all for this one! If you find yourself wanting more, Pinecone Macro Research has another Substack - The Pinecone Weekly Brief which is the first few pages of our flagship Cascade letter.

To learn more about our firm and our offerings like The Cascade and our deep dive pro tier The Emerald - head to our website.

Disclosure: Pinecone Macro Research, LLC is an independent research firm. Pinecone Macro’s letters are based upon information gathered from various sources believed to be reliable but are not guaranteed as to accuracy or completeness. There are risks in investing. Any individual report is not all-inclusive and does not contain all of the information that you may desire in making an investment decision. You must conduct and rely on your own evaluation of any potential investment and the terms of its offering, including the merits and risks involved in making a decision to invest. The information in this letter is not intended to be, and shall not constitute, an offer to sell or a solicitation of an offer to buy any security or investment product or service. The information in this report is subject to change without notice, and Pinecone Macro Research, LLC assumes no responsibility to update the information contained in this report. There is risk in trading markets. Pinecone Macro Research, LLC is not an investment advisor. The ideas and trades I share are my own and are for informational and educational purposes only and should not be construed as investment advice. Accordingly, you should not rely solely on the information in making any investment. You should always check with your licensed financial advisor to determine the suitability of any investments.

Asian Century Stocks put out a piece on double taxation:

https://www.simplify.us/sites/default/files/2021-02/simplify-investment-case-disruption-with-convexity.pdf

CEFConnect has a good overview of CEF's country funds.

i.e. discounts to NAV and historical distributions.

Yes, Africa is a empty void for a continent that is bigger than U.S., China, and most of Europe combined.